2021 electric car tax credit irs

Thats why fully electric vehicles are generally eligible for. Use this form to claim the credit for certain plug-in electric vehicles.

What Is Irs Form 8910 Alternative Motor Vehicle Credit Turbotax Tax Tips Videos

The new law eliminates that limit.

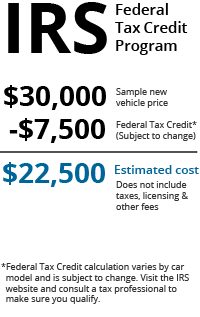

. A B C X Your federal tax credit amount Keep in mind the maximum amount you can receive for this specific tax credit is 7500. Table of Contents show. When you buy an electric or plug-in hybrid vehicle you may qualify for a federal tax credit that reduces your income tax liability.

Leases do not qualify however since the manufacturer receives the tax credit. The federal tax credit for EVs and hybrid vehicles is capped at 7500 but not all cars qualify for the credit. The federal tax credit for EVs tapers down once the automaker sells 200000 eligible cars.

Qualified Electric Vehicle Credit. Attach to your tax return. Visit FuelEconomygov for an insight into the types of tax credit available for specific models.

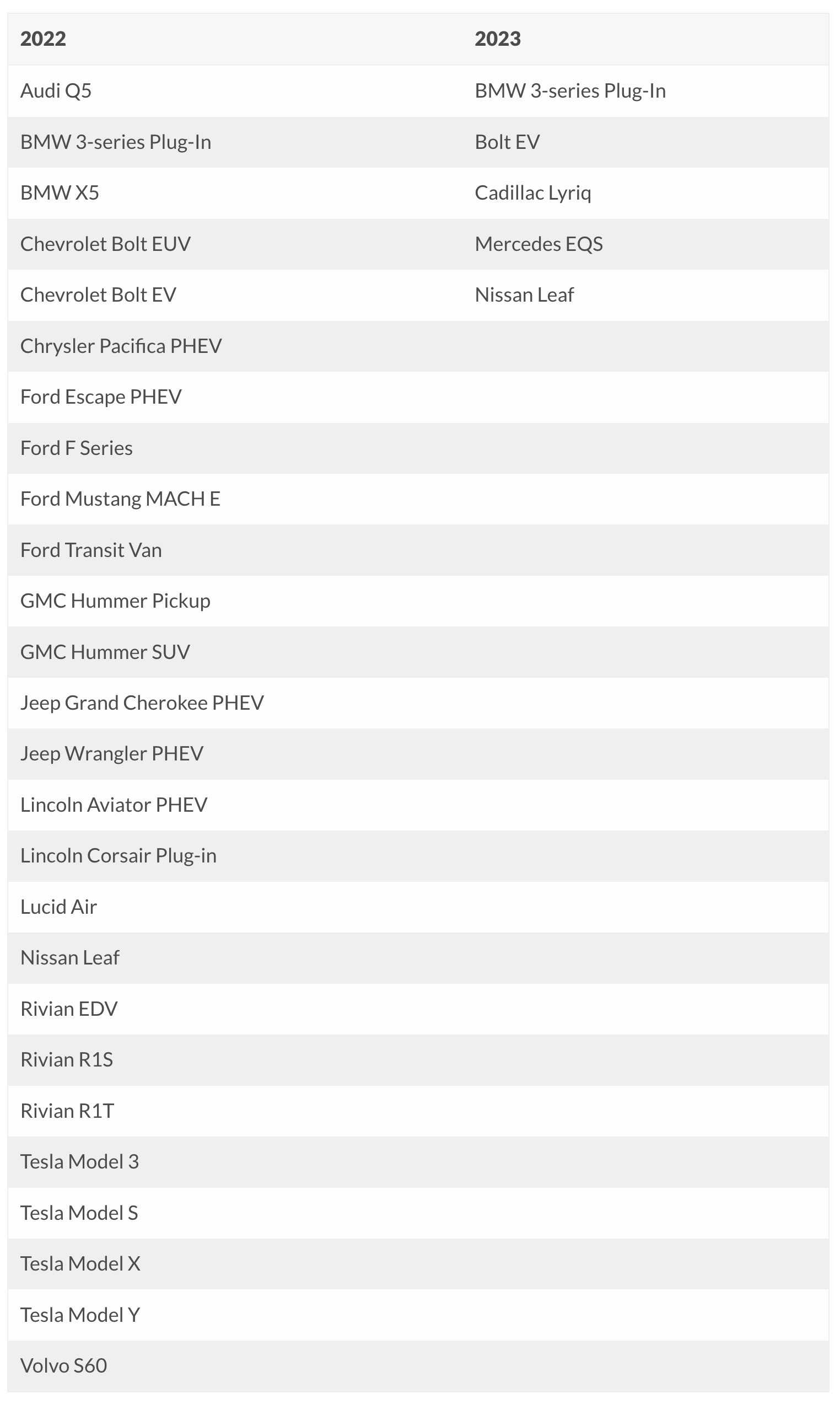

However if you acquired the two-wheeled vehicle in 2021 but placed it in service during 2022 you may still be able to claim the credit for 2022. Electric Cars Eligible for the Full 7500 Tax Credit. Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV credit for purchasing a new electric vehicle after August 16 2022 which is the date that the Inflation Reduction Act of 2022 was enacted a tax credit is generally available only for.

Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. 1545-2137 Attachment Sequence No. You can get 7500 back at tax time if you buy a new electric vehicle.

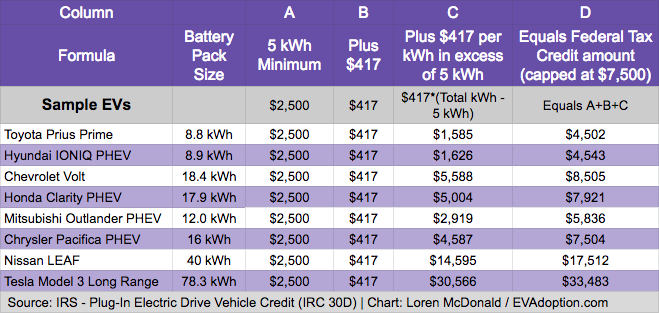

The amount of credit you are entitled to depends on the battery capacity and size of the vehicle. Do not report two-wheeled vehicles acquired after 2021 on Form 8936 unless the credit is extended. This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours.

E-Tron EV E-Tron Sportback EV E-Tron SUV EV A7 TFSI e Quattro PHEV Q5 TFSI e Quattro PHEV Bentley. Beginning on January 1 2022. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US.

The IRS calculates the credit based on the size of a vehicles battery pack. While that doesnt translate into direct savings off the purchase price you may get some delayed gratification after April 15. The plans also include an increased amount of up to 12500 income thresholds as mentioned and reverting the phaseout period.

Updated information for consumers as of August 16 2022 New Final Assembly Requirement If you are interested in claiming the tax credit available under section 30D EV credit for purchasing a new electric vehicle after August 16 2022 which is the date that the Inflation Reduction Act of 2022 was enacted a tax credit is generally available only for qualifying electric vehicles for. While there has been a 7500 credit for electric vehicles the credits were capped at 200000 per manufacturer. These include a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit and an income limit for buyers to 100000.

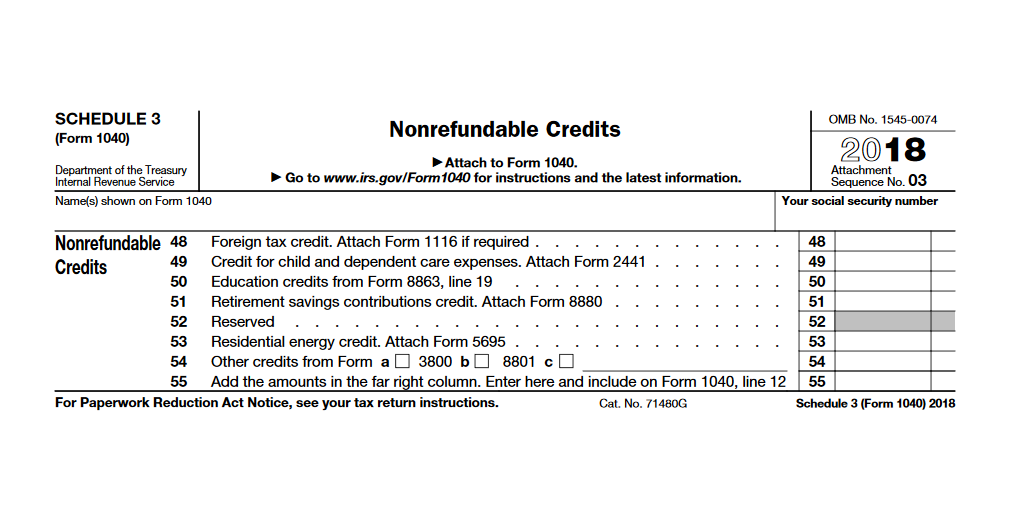

Claim the credit for certain alternative motor vehicles on Form 8910. The tax credit is also available on fuel cell electric vehicles and plug-in hybrid electric vehicles but the amount can vary based on battery size. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit.

XC60 T8 Recharge Extended Range 7500. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles. Electric cars are entitled to a tax credit if they qualify.

The IRS uses the following equation to determine the amount of credit. So how much is the federal tax credit worth. The credit for qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021.

The tax credit expires for each manufacturer after more. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Higher income buyers will no longer be eligible for the tax credit which will now be capped at 150000 for single filers and 300000 for joint filers.

Qualified two-wheeled plug-in electric vehicles expired for vehicles acquired after 2021. Filemytaxes November 1 2021 Tax Credits. The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

For instructions and the latest information. The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. A buyer of a new electric car can receive a tax credit valued at between 2500 and 7500.

A 2500 for a minimum of a 5kWh battery pack B 417 for all battery packs C 417 per kWh of a battery pack greater than 5 kWh. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible.

Theres also a limit on which vehicles qualify for the credit. Size and battery capacity are the primary influencing factors. The value of the IRS tax credit ranges from 2500 to 7500 depending on the electric vehicle in question.

Whats the federal tax credit for electric cars in 2021. Do not report two-wheeled vehicles acquired after 2021 on Form 8936 unless the credit is extended. However if you acquired the two-wheeled vehicle in 2021 but placed it in service during 2022 you may still be able to claim the credit for 2022.

XC40 Recharge Pure Electric P8 AWD. Part I Tentative Credit. Cars costing more than 55000 or pickups SUVs or vans costing more than 80000 will no longer be eligible.

Names shown on return.

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Ford Ev Tax Credits May Run Out Sooner Than Expected

Irs Fails To Stop Electric Car Tax Credit Cheats

Tax Credit On Vehicle Home Ev Chargers Irs Form 8911 Youtube

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

2015 2021 Form Irs 8822 Fill Online Printable Fillable Blank Pdffiller Money Template Change Of Address Irs

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

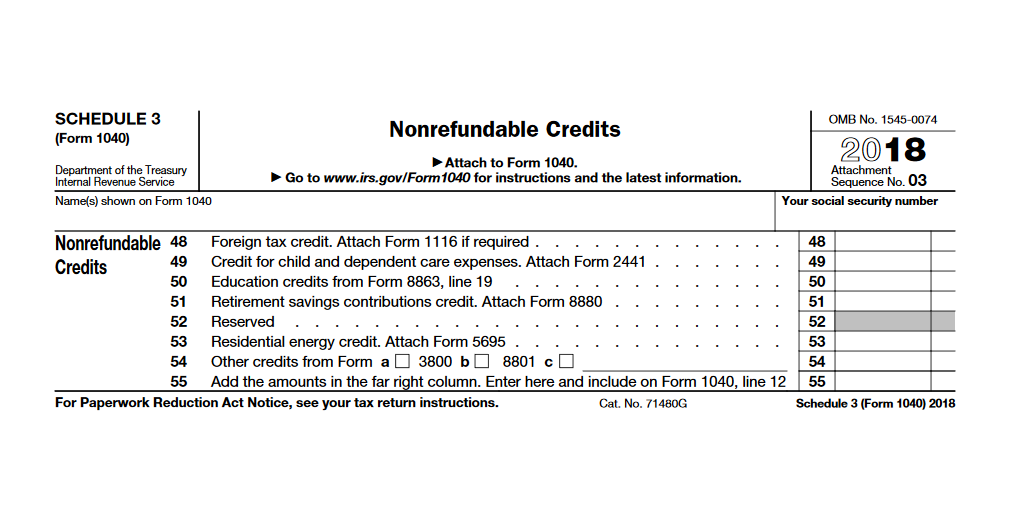

Irs Schedule 3 Find 5 Big Tax Breaks Here

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

Why Only 3 Auto Manufacturer S Ev Sales Data Is Being Reported Publicly By The Irs Evadoption

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Irs Tax Tracker How Long Does It Take For Irs To Approve Refund Marca

What Is Tax Debt How Can I Pay It Off Quickly

Gift Electric Car To Spouse Get Tax Credit Internal Revenue Code Simplified

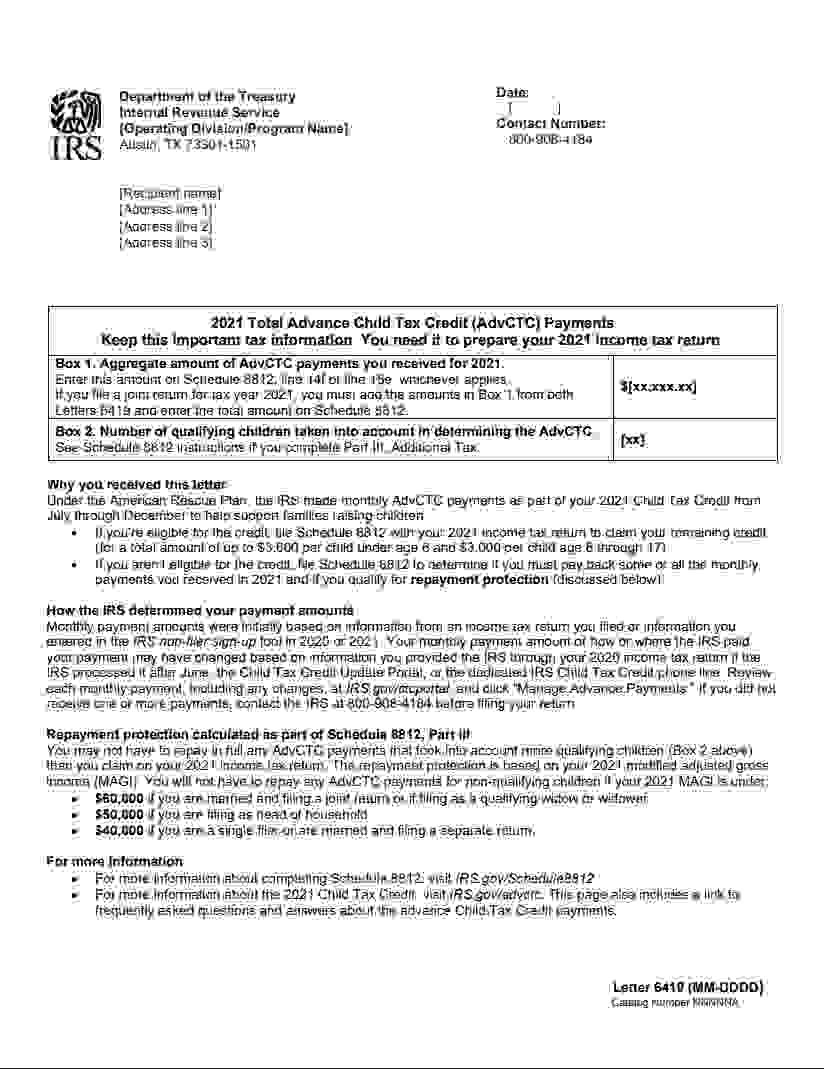

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates